- Victory Tax Brief

- Posts

- Reasonable Collection Potential: The Number That Makes or Breaks Your OIC

Reasonable Collection Potential: The Number That Makes or Breaks Your OIC

The Victory Tax Brief | Issue #12

An Offer in Compromise (OIC) can settle your IRS debt for less than you owe, but only if your Reasonable Collection Potential (RCP) supports it. RCP is the IRS’s estimate of what it can realistically collect from you based on assets, income, and allowable living expenses. Get this number right, and your offer has a shot. Get it wrong, and it’s an easy rejection.

At Victory Tax Lawyers, we help clients take action early, before audits turn into investigations and before debts turn into levies or liens. If you’re unsure whether your situation calls for legal help, here’s when to make the call.

Call (800) 883-8301 now for a free consultation.

✅ What Is RCP — and Why It Matters

RCP = Asset equity + Future disposable income.

If your offer ≥ RCP, the IRS may consider it. If offer < RCP, rejection is likely.

The IRS uses strict guidelines (including national/local expense standards) to keep evaluations consistent.

📊 What the IRS Looks At

Assets:

Real estate (quick-sale value ≈ 80% FMV minus loans)

Vehicles (minus loan balance, quick-sale discount)

Bank accounts: balances above $1,000 count

Retirement/investment accounts (less penalties)

Business assets (with possible exclusions if essential to operations)

Future income:

Monthly disposable income × 12 (lump-sum offer)

Monthly disposable income × 24 (periodic payment offer)

Allowable expenses:

National Standards (food, clothing, misc.)

Local Standards (housing, utilities, transportation)

Special circumstances (medical, dependents, hardship) may justify higher allowances

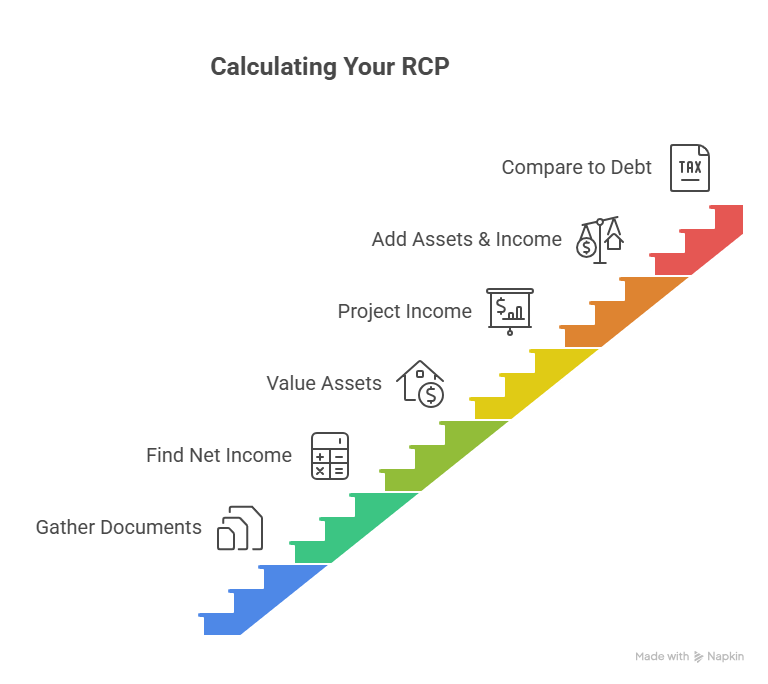

🧮 How to Calculate Your RCP (Step-by-Step)

Gather documents: pay stubs, bank statements, tax returns, loan balances, asset values

Find monthly net income: total income minus allowable expenses

Value assets: quick-sale value minus debts (homes, cars, cash, retirement, business tools)

Project future income: disposable income × 12 (lump-sum) or × 24 (periodic)

Add assets + future income: that’s your RCP

Compare to your tax debt: if RCP < liability (and you qualify), you may be a strong OIC candidate

🔻 Legal Ways to Lower Your RCP

Document expenses thoroughly: medical, childcare, dependent care, special needs — prove them.

Minimize exposure (legally): show accurate equity after discounts, loans, penalties; substantiate business-necessary assets.

Work with a tax attorney: align your numbers with IRS standards and present a defensible case.

🚫 If the IRS Rejects Your OIC Based on RCP

Appeal (Form 13711) within the deadline; address the IRS’s reasons with new proof.

Amend and resubmit with corrected income/expense evidence.

Consider alternatives: Installment Agreement, Currently Not Collectible (CNC) status, or in rare cases, bankruptcy.

Want to read the full blog post? Head to our website →

👩⚖️ When to Hire a Tax Attorney

Complex assets or irregular income

High-dollar debts or prior OIC rejection

Need to leverage national/local standards and hardship exceptions effectively

We build offers the IRS can say yes to, and protect you from paying more than the law requires.

FAQs

Can I negotiate my RCP? Yes — with strong documentation and proper legal framing.

How often are OICs accepted? Historically < 40%; accuracy and evidence drive approvals.

Does my spouse’s income count? Often, yes (especially joint/community income).

What if I misstate info? Expect rejection — and possible legal consequences.

Does RCP affect credit? RCP itself doesn’t; outcomes and reporting might.

How much should I offer? At or above your calculated RCP, supported by evidence.

⚡ Ready to Calculate (and Optimize) Your RCP?

Before you send anything to the IRS, make sure your numbers are exact and documented. A small mistake can cost you months and a shot at real relief.

Victory Tax Lawyers: We negotiate with the IRS, file appeals, and build legal strategies to stop levies before they happen. Don’t risk your paycheck, bank account, or property.

Don’t leave it to chance. Call (800) 883-8301 or request your free consultation now. Let us make sure you keep what you deserve—and avoid what you don’t.