- Victory Tax Brief

- Posts

- IRS Notice LT11: What It Means and How to Stop a Levy

IRS Notice LT11: What It Means and How to Stop a Levy

The Victory Tax Brief | Issue #8

Receiving an IRS Notice LT11 can be a shock. It’s the IRS’s final warning before serious collection actions begin — things like garnished wages, frozen accounts, or even seizure of property. The good news? You still have options if you act quickly.

At Victory Tax Lawyers, we help clients respond to LT11 notices strategically. From filing appeals to negotiating payment plans, we protect your income, assets, and future. Don’t wait until the IRS makes the first move. Call (800) 883-8301 now for a free consultation.

✅ What Is IRS Notice LT11?

This notice is the IRS’s final intent to levy. If ignored for 30 days, the IRS can begin:

Freezing your bank account

Garnishing your wages

Seizing your property

Filing a federal tax lien

Intercepting your tax refunds

Even recommending passport revocation

It’s not just a letter. It’s your last chance to stop aggressive action.

⚠️ What Happens If You Ignore It?

Delaying makes the problem worse:

Penalties and interest keep compounding

You may lose access to assets

Credit damage becomes harder to repair

Passport issues can impact work and travel

The IRS doesn’t back down once LT11 is issued.

💡 What You Can Do Now

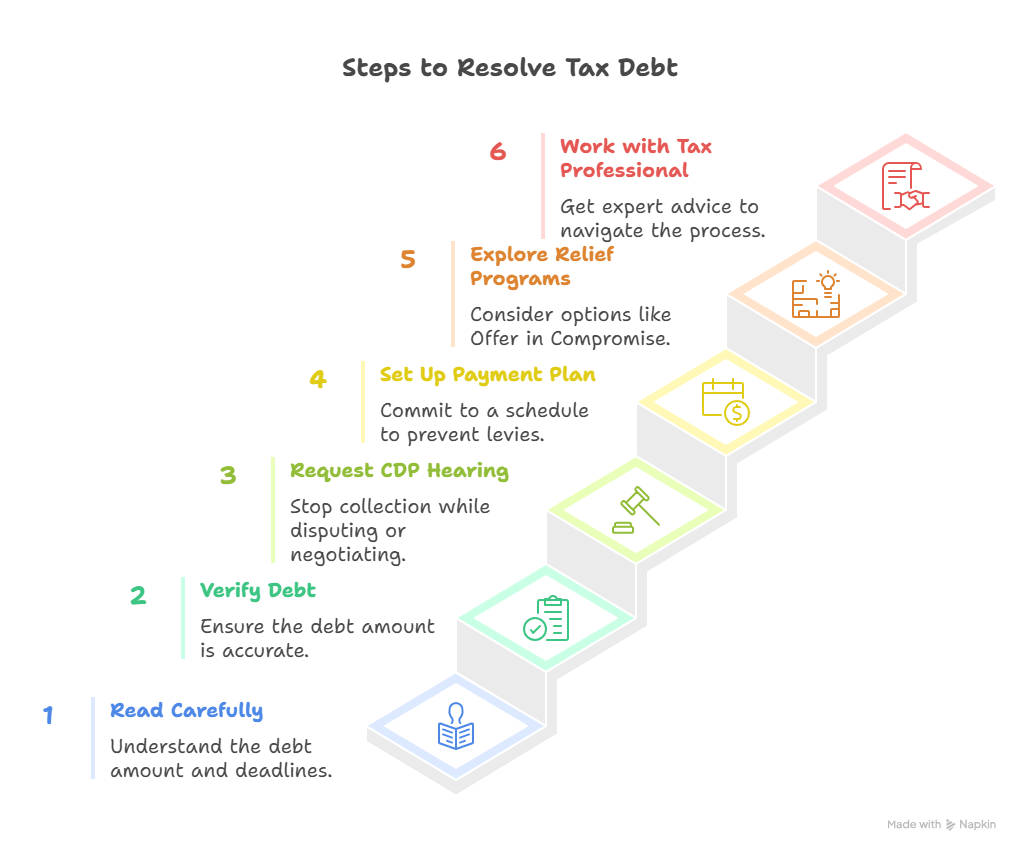

Here are smart steps to take immediately:

Read carefully — Understand the debt amount and deadlines.

Verify the debt — Errors happen; make sure the amount is accurate.

Request a CDP hearing — Stop collection while you dispute or negotiate.

Set up a payment plan — Prevent levies by committing to a schedule.

Explore relief programs — Options like Offer in Compromise or CNC status may reduce or pause your obligation.

Work with a tax professional — The IRS has teams of experts. You should too.

Want to read the full blog post? Head to our website →

⚡ Why Acting Fast Matters

Waiting even a few weeks after LT11 can lock you out of options that might otherwise protect your assets. You control the timeline — until the IRS takes it away.

Victory Tax Lawyers: We negotiate with the IRS, file appeals, and build legal strategies to stop levies before they happen. Don’t risk your paycheck, bank account, or property.

Don’t leave it to chance. Call (800) 883-8301 or request your free consultation now. Let us make sure you keep what you deserve—and avoid what you don’t.