- Victory Tax Brief

- Posts

- Do Tax Relief Programs Really Work? Here’s the Truth

Do Tax Relief Programs Really Work? Here’s the Truth

The Victory Tax Brief | Issue #19

If you owe the IRS, you’ve probably seen ads promising to “settle your tax debt for pennies on the dollar.” That naturally leads to one big question: do tax relief programs actually work?

The short answer is yes, but only for taxpayers who truly qualify. IRS tax relief programs are legitimate, government-backed solutions designed to help people resolve back taxes, reduce penalties, and create manageable repayment paths. The problem is that not everyone qualifies, and many companies oversell results while charging high fees.

At Victory Tax Lawyers, we help clients navigate complex tax issues, from audits and back taxes to liens and fraud investigations.

If you’re unsure whether you need expert help, call (800) 883‑8301 for a free consultation.

✅ What Tax Relief Programs Actually Are

Tax relief programs are real IRS options, not loopholes. They exist to help taxpayers who are genuinely unable to pay their tax debt in full.

Common IRS tax relief options include:

Installment Agreements to spread payments over time

Penalty Abatement to remove IRS penalties when reasonable cause exists

Offer in Compromise (OIC) to settle tax debt for less than the full balance

Currently Not Collectible (CNC) status to pause collections during hardship

These programs are meant to encourage compliance while preventing financial collapse.

⚠️ Who Typically Qualifies (and Who Doesn’t)

Not everyone qualifies for tax relief. The IRS looks closely at:

Income and monthly expenses

Assets and equity

Filing compliance

Ability to pay the full balance over time

If the IRS believes you can pay your tax debt, relief may be denied even if it feels financially difficult. This is where many taxpayers get tripped up.

If you’re unsure whether you qualify, reach out before applying. A bad application can delay resolution or make matters worse. Call (800) 883-8301 to discuss your situation.

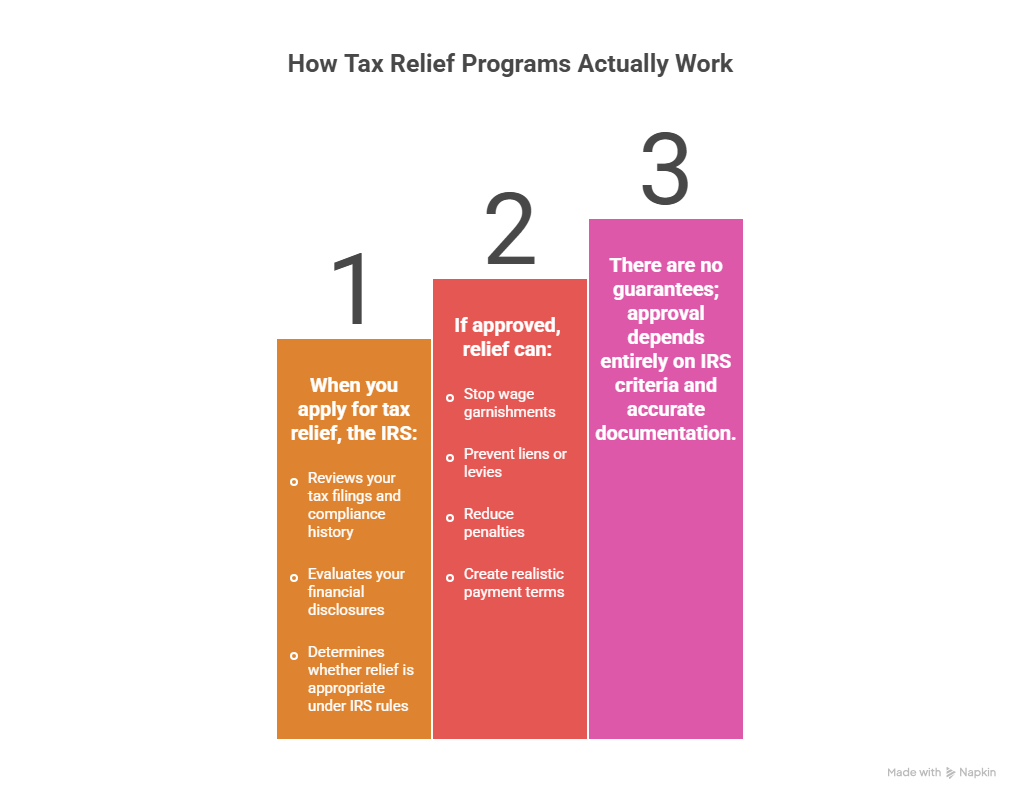

🛠 How Tax Relief Programs Actually Work

When you apply for tax relief, the IRS:

Reviews your tax filings and compliance history

Evaluates your financial disclosures

Determines whether relief is appropriate under IRS rules

If approved, relief can:

Stop wage garnishments

Prevent liens or levies

Reduce penalties

Create realistic payment terms

There are no guarantees; approval depends entirely on IRS criteria and accurate documentation.

If you want to know the most common pitfalls to avoid. Read the full blog post on our website →

⚡ So… Do Tax Relief Programs Deliver Results?

Yes, when used correctly. For qualifying taxpayers, IRS relief programs can reduce balances, eliminate penalties, and stop aggressive collection actions. The key is understanding eligibility and applying strategically.

Victory Tax Lawyers has helped clients resolve tax debt, stop enforcement, and regain financial stability - with over $72 million saved since 2017.

Call (800) 883-8301 or schedule a free consultation to find out whether tax relief is a real option for you before the IRS decides for you.